[ad_1]

Sakorn Sukkasemsakorn

Dangerous belongings aren’t funding to organize for the recession however these intervals could enable entry level within the talked about asset class. If the US financial system will keep away from the recession, we’ve to take advantage of declining charges, which have traditionally been optimistic for the inventory market and small-cap corporations are amongst one of the best performers in these circumstances.

I are likely to keep away from investing and valuing corporations like Web Energy(NYSE:NPWR), however I personally respect the enterprise alternatives and ideas, see potential, and add it to my portfolio. I’ll begin with a brief excursus concerning the know-how and market, persevering with with the current quarter outcomes, to confirm that by now the whole lot goes as deliberate; and to provide you with a valuation utilizing the actual choices mannequin.

The Market and Aggressive Benefit

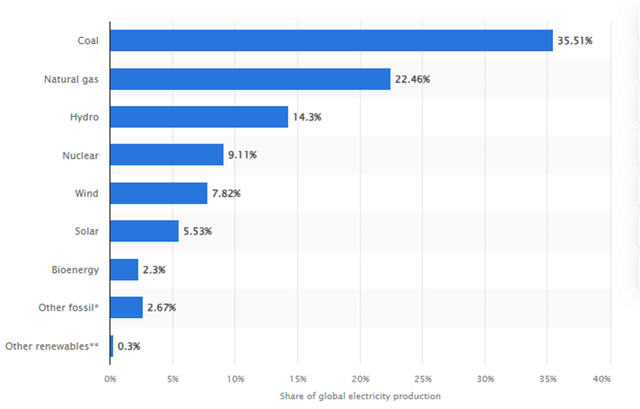

Share of World electrical energy manufacturing (Statista)

Regardless of the rising share of fresh vitality know-how, thermal stations are prevailing in vitality technology, with coal and pure fuel vegetation having 2/3 of the market share. The effectivity of the stations elevated within the coming years, however Pure Gasoline vegetation, for instance, apart from the vitality, additionally produce a substantial quantity of nitrogen oxides (NOx), whereas coal stations add additionally sulfur oxides (SOX), hydrargyrum and particulates that have an effect on our well being and atmosphere. To battle this drawback amongst others the Allam energy cycle, named after the inventor and Nobel Peace Prize award winner Rodney John Allam, generates the electrical energy for fossil fuels with built-in carbon dioxide seize. To confirm the speculation, the Web Energy 50MW demonstration plant was constructed the place totally different components had been examined and all of the statistical information was documented.

In line with the analysis, evaluating the Oxy-fuel cycles, the Allam cycle has the very best energetic effectivity (55.1%) and financial efficiency and comparatively easy configuration, requiring a combustor and turbine. Furthermore, the Cycle delivers energy cleaner than post-combustion carbon seize kind conventional fuel energy technology vegetation with decrease LCOE.

The advantages of the Web Energy Cycle:

- Clear: can seize CO2 at >97% price and no NOx, SOx or particulate emissions to environment;

- Dependable: focused capability issue of 92.5%;

- Low-Value: $21-$40 $/MWh within the U.S;

- Will make the most of the present infrastructure;

- Compact footprint: roughly 13 acres.

The Firm Overview

NET Energy was listed by way of merging with the Rice Acquisition Corp. II SPAC, starting to commerce in 2023 on NYSE. Normally, this doesn’t point out funding, however this could be an exception. It’s a new powerplant that’s working utilizing the Allam-Fetvedt Energy Cycle, which permits for considerably lowering CO2 emissions (nearly to 0) and will increase the effectivity of the ability plant. Its purpose is to provide delivery to low-cost “clear” and dependable electrical energy utilizing a patented extremely recuperative oxy-combustion course of, combining two applied sciences:

• Oxy-combustion, a clear warmth technology course of wherein gas is blended with oxygen such that the ensuing byproducts from combustion include solely water and pure CO2; and

• Supercritical CO2 energy cycle, a closed or semi-closed loop course of which replaces the air or steam utilized in most energy cycles with recirculating CO2 at excessive strain, as sCO2, producing energy by increasing sCO2 repeatedly by way of a turbo expander.

The corporate already had a optimistic expertise with its check energy plant, reaching know-how validation and now could be in preparation to launch its first utility-scale plant wherever between the second a part of 2027 and first half of 2028.

The Firm`s Enterprise

Web Energy enterprise will likely be licensing its know-how providing totally different plant designs kind 25MW to industrial models of 300MW. Many of the components have a patent (round 424) with long-term expiration. The primary-generation utility-scale plant ought to show the working idea and focusing on to seize round 97% of CO2

The primary-generation should verify its reliability as a way to improve effectivity (acknowledged by the cycle) to change for Gen2.

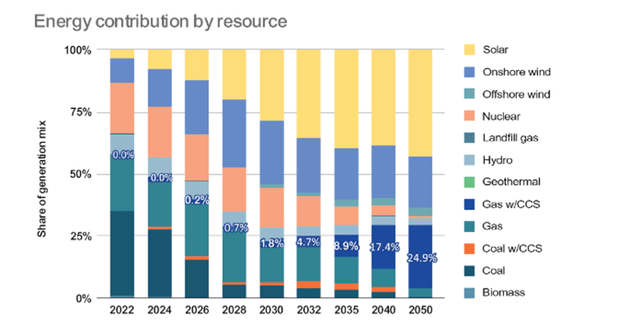

It’s anticipated that by 2050 Web Energy would provide -25% of complete electrical energy demand and could be the popular source of fresh agency capability.

Vitality contribution by sources (DeSolve)

The current quarter outcomes

|

Yr |

2.2024 |

1.2024 |

4.2023 |

3.2023 |

|

Money and Money equivalents |

405.15 |

428.60 |

536.90 |

545.20 |

|

Quick-term investments |

100.00 |

100.00 |

100.00 |

100.00 |

|

Quick-term Investments in securities, available-for-sale |

74.22 |

69.19 |

||

|

Lengthy-term investments in securities available-for-sale |

27.43 |

27.79 |

||

|

Complete |

606.80 |

625.58 |

636.90 |

645.20 |

|

EBITDA |

-24.81 |

-18.73 |

-22.20 |

-35.40 |

|

EBITDA month-to-month |

-8.27 |

-6.24 |

-7.40 |

-11.80 |

|

Money runway (solely money and money equivalents) |

49.00 |

68.66 |

72.55 |

46.20 |

|

Money runway (Money+brief time period investments in securities) |

70.06 |

95.77 |

86.07 |

54.68 |

|

Money runway (Money+ lengthy and short-term investments in securities) |

73.38 |

100.22 |

86.07 |

54.68 |

In mln. of USD besides money runway numbers

Source: The writer`s calculations utilizing the corporate`s quarterly statements and SeekingAlpha knowledge

Money burn continued to rise with the money and money equivalents solely runway equal to 49 months, nevertheless it possibly nonetheless sufficient taking into account that the corporate wants round 3 years to complete the plant. It needs to be talked about that the calculations don’t embrace the curiosity revenue that firm receives kind the securities investing actions. If we are going to have in mind long-term and short-term investments in available-for-sale securities, the money runway is the additional 70 months.

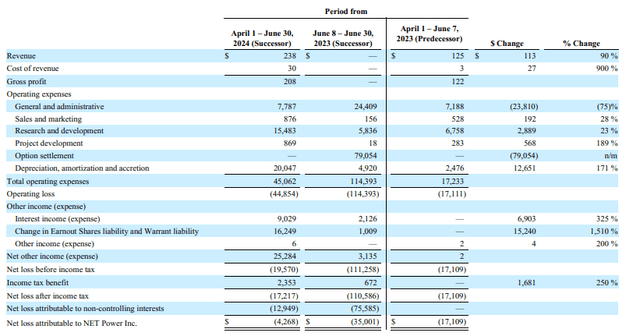

NPWR Earnings statements comparability (SEC filings)

The revenues elevated by 90%, for the three newest months, this was resulting from gross sales in check knowledge on the NPWR Demonstration Plant. The lower in Common and Administrative bills is because of the next base attributable to the Enterprise Mixture. The variety of staff is rising, leading to greater advertising and marketing and gross sales prices. Undertaking growth bills, as anticipated, elevated as the corporate made additional steps for the event of a utility-scale plant. The corporate is on monitor to start testing.

Criticism of the cycle and dangers

Apart from some compliments, there’s a criticism of the cycle. The primary query that arose in my thoughts throughout the studying was CO2 sequestration, which isn’t a simple course of requiring storage (with unknown long-term outcomes) and extra prices.

The second query is concerning the economics of the 300MW plant, which isn’t clear, and the quoted sentence from the SEC report “We imagine that our present sources of liquidity readily available ought to be adequate to fund our common company working bills as we work to commercialize our know-how, however sure prices aren’t fairly estimable presently and we could require further funding” doesn’t give a confidence as nicely.

Warrant holders and prices that will likely be paid by the corporate’s shares are posing dangers for the dilution.

Lack of know-how in regards to the check facility, with the rising rumors that even 50MW had been by no means produced and issues with the turbine.

The patent will expire in 2030, near the industrial date, which can enable opponents to enter and reduce the quantity and worth of the corporate’s license charges.The following dangerous half is elements, the combustor and turbine must be first of a form which will increase the danger of failures and will improve the time when the plant will likely be prepared.

Valuation technique

For the primary time, I made a decision to make use of the actual choices technique. It helps to worth the challenge that doesn’t deliver cash but however permits us to deliver it sooner or later by exploiting the patent. The mannequin permits enter time frames, prices, and the longer term end result for the corporate holding exclusivity within the product. This money flows are valued as a name possibility contract with the Strike value equal to preliminary investments, Normal deviation equal to the business SD 19.88%, challenge lifetime of 4 years (because the plant is predicted to be prepared in 2028) and risk-free price of 4% (US Treasury Yield). The result money circulation is calculated utilizing the corporate’s displays and a reduction price of 10% (urged by the corporate in its PV calculations). The preliminary investments are extrapolated from the 50 MW plant ($140 mln).

Valuation outcomes

| Inventory Value= | 2605 | Danger-free price= | 4% | |

| Strike Value= | 840 | Variance= | 0.03992 | |

| Expiration (in years) = | 4 | |||

| d1 = | 0.929995 | |||

| N(d1) = | 0.823813 | |||

| d2 = | 0.530395 | |||

| N(d2) = | 0.702081 | |||

| Worth of the patent = | 287 | |||

| Worth of Widespread Fairness | 1017.5 | |||

| Variety of shares excellent | 72.6 | |||

| Value per share | $ 14.02 |

In mln. of USD besides per share quantity

Valuation dangers

The valuation may be very delicate to risk-free price and time horizon and talent to attain the required money circulation.

Money flows had been simulated utilizing the forecasts from the displays of the corporate and analysis from DeSolve LLC and REPEAT, any deviation could negatively or positively have an effect on the valuation, even though I attempted to make use of a pessimistic situation.

The variance is the business common for the previous 3 years. The circumstances of the choice ought to be intently watched on occasion to regulate the valuation.

Because of the lack of awareness, preliminary investments had been concluded from 50MW, the actual prices could also be decrease or greater, affecting the valuation. Some great benefits of tax credit score 45Q aren’t considered, this may additional have a positive impact on valuation.

Conclusion

Bearing in mind the present value (round $8 on the time of writing) and valuation calculations, there’s a 69% upside potential, this permits me to assign a “Purchase” ranking, however not a “Sturdy Purchase”, resulting from many questions and complexities that the corporate and shareholders will face as the corporate is on starting to commercialization however the prospects appear to be vibrant if the whole lot will occur as deliberate. If the steps will likely be confirming the corporate’s presentation the valuation is much past the acknowledged value goal. The very last thing I’ve to say is that it doesn’t imply that one has to enter with a noticeable share of the portfolio, handle your dangers. The corporate has a protracted technique to go to show the know-how and dealing mannequin.

[ad_2]

2024-08-19 10:15:47

Source :https://seekingalpha.com/article/4715571-net-power-the-risky-bet-on-new-energy-technology?source=feed_all_articles

Discussion about this post