[ad_1]

Richard Drury

Liberty All-Star Fairness (NYSE:USA) is a compelling investing automobile for buyers that need to mix tech publicity with a excessive dividend yield.

USA is a closed-end fairness fund that owns among the largest names within the tech trade in its portfolio and that has achieved enticing, double-digit returns within the final decade. The closed-end fairness fund offers buyers with a ten% dividend yield because it distributes capital positive aspects dividends and is a compelling funding possibility, for my part, for buyers that need to be uncovered to the factitious intelligence theme.

Diversification, excessive passive revenue, and tech publicity are the three primary the reason why buyers may need to contemplate the Liberty All-Star Fairness Fund for his or her passive revenue portfolios.

Portfolio And Funding Goal

The Liberty All-Star Fairness Fund invests in each development and worth shares in massive corporations, largely within the U.S. Data Know-how sector. The fund’s primary targets are capital appreciation and revenue distribution to USA’s shareholders.

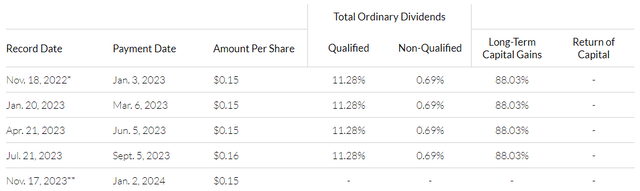

The Liberty All-Star Fairness Fund particularly seeks to pay distributions on its shares equal to roughly 10% of its internet asset worth each year, which makes USA primarily a passive revenue automobile for buyers. The fund’s distributions are primarily paid out of realized long-term capital positive aspects, and the fund’s quarterly dividends are taxed as bizarre dividends.

Lengthy-Time period Capital Beneficial properties (Liberty All-Star Fairness Fund)

The newest distribution is $0.18 per share per quarter, which equates to a ten.4% main dividend yield. The Liberty All-Star Fairness Fund is, like I mentioned, predominantly comprised of enormous cap U.S. investments and manages roughly $2.0 billion in belongings. The fund’s present expense ratio sits at 0.93%.

The fascinating factor about Liberty All-Star Fairness Fund is that the closed-end fund combines tech publicity and diversification with recurring dividend revenue. The fund presently pays buyers a ten% yield, paid quarterly, and buyers may doubtlessly revenue from the fund’s specific deal with the factitious intelligence theme.

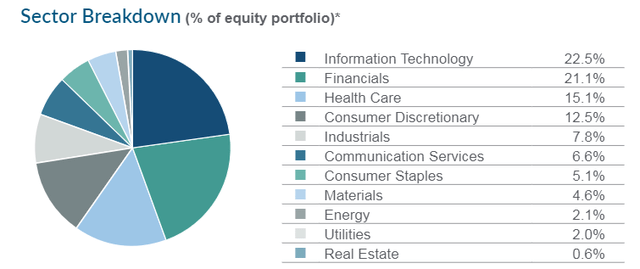

Nearly all of investments within the firm’s portfolio are a part of the Data Know-how sector which had a portfolio weighting of twenty-two.5% which incorporates quite a lot of shares which can be poised to revenue from rising AI investments. The second-biggest sector was Financials (21.1%), adopted by Well being Care (15.1%).

Sector Breakdown (Liberty All-Star Fairness Fund)

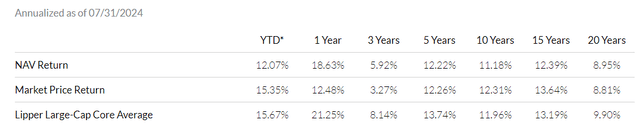

Efficiency Historical past

Liberty All-Star Fairness Fund profited within the final 12 months from a powerful efficiency report of know-how investments, leading to an 18.6% return on internet asset worth.

The long-term return can be enticing, because the fund achieved 11.2% NAV returns within the final decade. The benchmark for the Liberty All-Star Fairness Fund is the Lipper Massive-Cap Core Mutual Fund Common.

NAV Return (Liberty All-Star Fairness Fund)

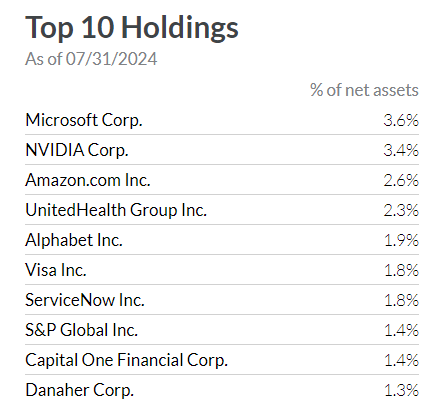

High Holdings Breakdown And AI Focus

Liberty All-Star Fairness Fund is primarily centered on the knowledge know-how trade, as I simply highlighted. NVIDIA Corp. (NVDA), Microsoft Corp. (MSFT), Amazon.com (AMZN) and Alphabet Inc. (GOOG) are high holdings for the closed-end fund and Microsoft was USA’s largest holding with a portfolio weighting of three.6% as of July 31, 2024.

The Liberty All-Star Fairness Fund comprises a substantial variety of investments which have publicity to the factitious intelligence theme. Corporations like Nvidia and Alphabet have been massive winners final 12 months as they profited from the company sector’s spending spree on GPUs which can be particularly geared in direction of AI functions.

Nvidia just lately clarified, to call only one instance, that it expects its newest Blackwell chips to ship out to clients on the finish of the 12 months and that it expects billions of gross sales from its newest GPU.

Since Nvidia has a 3.4% weighting in Liberty All-Star Fairness Fund’s portfolio, an ongoing outperformance of AI shares may help the fund’s internet asset worth development shifting ahead.

High 10 Holdings (Liberty All-Star Fairness Fund)

Low cost To NAV

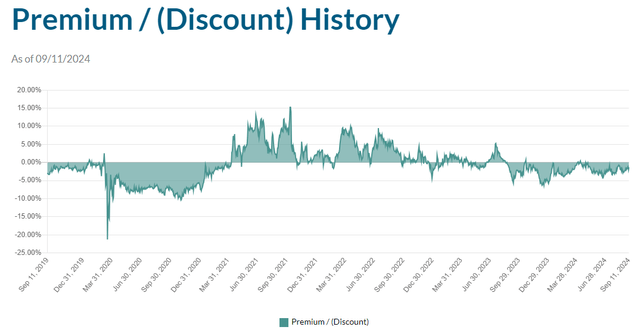

The Liberty All-Star Fairness Fund, as of 09/11/2024, was $6.96 whereas the fund’s market worth was $6.87 which suggests a reduction to internet asset worth of 1.29%.

The Liberty All-Star Fairness Fund has traditionally offered each at a premium and at a reduction to internet asset worth, at various instances, making it laborious to make a generalized assertion concerning the fund’s valuation historical past.

Within the long-run, I anticipate the Liberty All-Star Fairness Fund’s internet asset worth to develop and to promote at or close to internet asset worth because the portfolio is made up of extremely liquid inventory investments within the massive cap market. The prospects for NAV development are superb, for my part, as the corporate owns market leaders within the dominant Data Know-how sector.

Low cost To NAV (Liberty All-Star Fairness Fund)

What Dangers Do Buyers Have To Account For

Clearly, the Liberty All-Star Fairness Fund is targeted on know-how corporations and consists of among the most infamous names within the know-how world, Nvidia, Microsoft and Alphabet. Thus, buyers should acknowledge that the USA closed-end fairness fund is primarily allocating funding funds to the cyclical know-how sector which exposes buyers to appreciable dangers in case investor capital rotates into different sectors, for example in case tech strikes out of favor with buyers.

Moreover, the Liberty All-Star Fairness Fund is invested primarily in procyclical corporations, so USA might be not going to be an ideal alternative for buyers throughout a recession.

My Conclusion

Liberty All-Star Fairness Fund is a compelling alternative for passive revenue buyers as a result of it combines diversification, revenue and appreciation potential associated to probably the most dominant names within the know-how trade.

As well as, the Liberty All-Star Fairness Fund has produced enticing, double-digit returns within the long-term whereas it expense ratio is under 1%.

The Liberty All-Star Fairness Fund could also be a lovely funding possibility for passive revenue buyers that need to acquire publicity to the quickly evolving data know-how trade, notably as a result of it consists of specific leaders resembling Alphabet or Nvidia.

As well as, Liberty All-Star Fairness Fund is a compelling funding automobile for buyers that need to ramp up their publicity to the factitious intelligence theme, which has captured the creativeness of buyers within the final 12 months. Purchase.

[ad_2]

2024-09-15 06:45:55

Source :https://seekingalpha.com/article/4721156-usa-tech-exposure-and-a-solid-10-percent-yield-liberty-all-star-equity?source=feed_all_articles

Discussion about this post