[ad_1]

Justin Paget/DigitalVision by way of Getty Photographs

Introduction

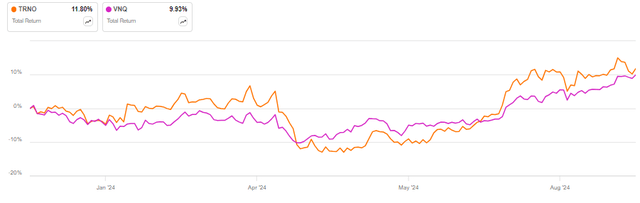

Terreno Realty Company (NYSE:TRNO) has marginally outperformed the Vanguard Actual Property Index Fund ETF Shares (VNQ) thus far in 2024, delivering a ~12% whole return in opposition to the ~10% achieve for the benchmark ETF:

TRNO vs VNQ in 2024 (Looking for Alpha)

I feel the shares will proceed to ship a return near that of main actual property ETFs, pushed by a fairly elevated valuation when it comes to FFO a number of (~27.6x) and market-implied cap price (~3.64%), but additionally potential for above-average internet working revenue /NOI/ progress for a number of extra years. The low gearing employed within the capital construction will even harm returns if the Fed cuts rates of interest, no less than in comparison with different extra levered REITs.

Firm Overview

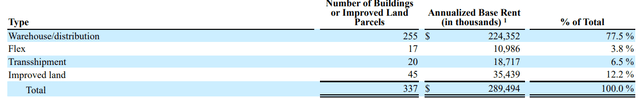

You’ll be able to entry all firm outcomes right here. Terreno Realty is an industrial REIT centered on Warehouse/distribution properties which account for 77.5% of annualized base hire (ABR), adopted by Improved land at 12.2%, Transshipment properties at 6.5%, with Flex (encompassing mild industrial and R&D) making up the remaining 3.8% of ABR:

Portfolio overview by property sort (Terreno Realty Type 10-Q for Q2 2024)

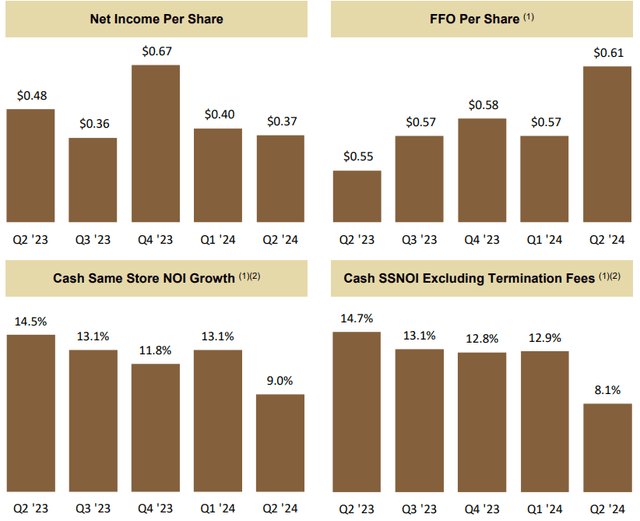

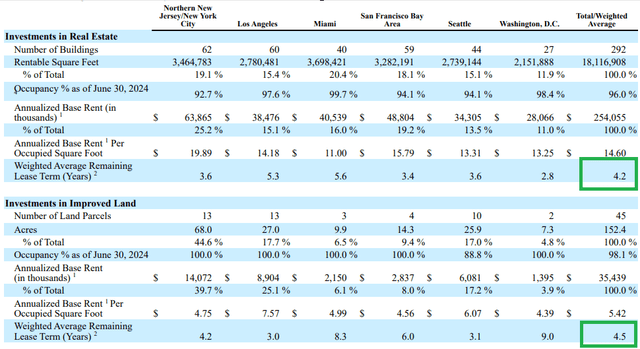

The corporate operates in six actual property markets, with Northern New Jersey/New York Metropolis its largest publicity at 25.2% of ABR, adopted by the San Francisco Bay Space at 19.2%:

Portfolio breakdown by property market (Terreno Realty Type 10-Q for Q2 2024)

Operational Overview

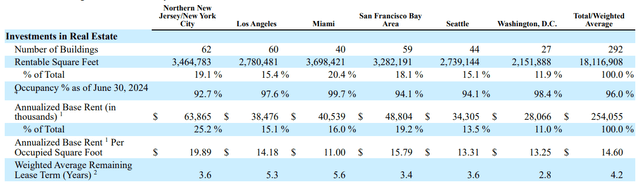

In Q2 2024, Terreno Realty reported an FFO of $0.61/share, up 11% Y/Y, pushed by each will increase in same-store internet working revenue (+9% Y/Y on a money foundation), in addition to a bigger portfolio.

Occupancy developments had been much less sturdy – occupancy stood at 96.2%, down 1.6% Y/Y. Leasing spreads stay distinctive, with the corporate reporting 45.9% larger rents on new and renewed leases.

Monetary Highlights (Terreno Q2 2024 Outcomes Presentation)

General Terreno Realty’s working efficiency metrics carefully mimic these noticed at its largest peer Prologis, Inc. (PLD) which I lined right here. Each firms are seeing a powerful improve in FFO powered by hire progress, however we’re additionally noticing cracks in occupancy rising as tenants face a lot larger hire charges on renewals.

Capital Construction

Terreno Realty ended Q2 2024 with a internet debt of $590 million. Consequently, internet debt accounts for simply 8% of the REIT’s $7.3 billion enterprise worth. 25.8% of the debt is floating price, indicating some advantages for the corporate’s money flows as quickly because the Fed begins slicing charges. That mentioned, the low gearing of the corporate will make the impact of Fed price cuts rather more restricted in comparison with different REITs that make use of leverage of 40-60% of their capital construction.

The weighted common curiosity price of the debt stood at 4% on the finish of Q2 2024, however has since marginally elevated because the REIT repaid a $100 million 3.8% time period mortgage in July 2024.

Market-implied cap price

In Q2 2024 the portfolio generated a money NOI of $64 million. As the quantity excludes $2 million in straight-line rents, I reckon it’s higher so as to add it again to reach at a run-rate NOI of about $66 million/quarter, or about $265 million yearly. Towards the $7.3 billion enterprise worth, the quantity represents a market-implied cap price of round 3.64% – extraordinarily low for a business REIT.

Normal and administrative bills are working at about $10.5 million 1 / 4, implying a circa $42 million burden from administration overhead on annual enterprise-level money flows. This would scale back the market-implied cap price by 0.58%, indicating an environment friendly working construction.

Valuation and prospects

Terreno Realty’s quarterly FFO run price ought to lead to ~$2.50/share in annual FFO. This is able to indicate the corporate at present trades a 27.6x FFO a number of, among the many highest valuations I’ve seen for a business REIT.

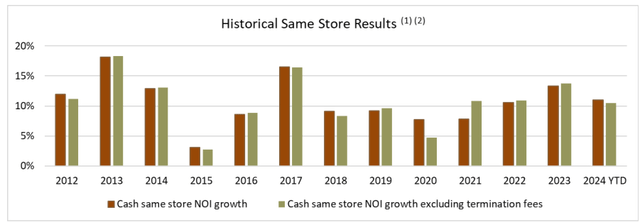

The reason, after all, lies in its sturdy internet working revenue progress pipeline, with money NOI progress at present working at 9% Y/Y. We must always be aware that this has already decreased from final 12 months’s 14.5% tempo and I might absolutely count on the pattern to proceed shifting down. Even so, NOI will proceed rising at an above-inflation tempo as legacy leases are repriced to market charges. Contemplating that the remaining common lease time period sits at 4.2 years for Actual Property and 4.5 years for Improved Land, the method ought to play out over the subsequent few years:

Lease expiration profile (Terreno Realty Type 10-Q For Q2 2024)

Even when we assume NOI will increase on the Q2 2024 tempo of 9% for the subsequent 4 years (one thing I don’t count on), the market-implied cap price would solely improve to five.1% in 2028, and would nonetheless be fairly elevated. Therefore, I’m comfortable to rank the shares a Maintain.

Dangers

The primary threat dealing with Terreno Realty is that it’s going to see continued declines in occupancy as the corporate adjusts rents to market ranges. This can undermine the REIT’s means to develop NOI, which might pull the rug out from beneath its valuation since sturdy NOI progress is principally taken with no consideration on the present valuation. Therefore, I might take note of whether or not the corporate shortly manages to fill its vacant models.

Since I’m impartial on the shares and skeptical they will proceed their sturdy NOI progress in the long run, it’s price enjoying satan’s advocate and highlighting that the corporate has seen above-average NOI progress since 2012. Therefore, it could proceed to take action sooner or later as properly:

NOI progress historical past (Terreno Q2 2024 Outcomes Presentation)

I might argue that the legacy very good NOI progress was achieved with a a lot smaller portfolio. Due to this fact, it isn’t very indicative of future progress potential above friends. As an example, whole belongings had been $1.1 billion in 2014, $2.1 billion in 2019, and $4.5 billion in H1 2024. As portfolio measurement will increase, it’s more durable to seek out actual property bargains that transfer the needle on the brand new a lot greater portfolio stage.

Conclusion

Terreno Realty reported sturdy FFO and NOI progress in Q2 2024. Nevertheless, contemplating the corporate’s ~27.6x FFO a number of and sub 4% market-implied cap price, these are already priced into the shares.

The REIT additionally runs a really conservative capital construction, with internet debt making up simply 8% of enterprise worth. Contemplating the outlook for Fed price cuts, I feel the corporate wants nothing in need of an actual property tsunami to outperform friends that are often using leverage wherever between 25% and 60% to beef up widespread shareholder returns.

All in all, contemplating the elevated valuation and the conservative capital construction, I feel a Maintain ranking is suitable for the shares. I merely don’t see them outperforming different actual property friends within the medium time period.

Thanks for studying.

[ad_2]

2024-09-03 20:32:31

Source :https://seekingalpha.com/article/4718762-terreno-realty-strong-noi-growth-is-already-priced-in?source=feed_all_articles

Discussion about this post