[ad_1]

BING-JHEN HONG

Momentum investing refers to a method constructed round the truth that each particular person shares and entire funds are likely to carry on performing once they’ve already been performing. Momentum is properly documented and works. So if it really works, why not lean into it by solely specializing in shares which have momentum and eliminating people who don’t? Effectively – that’s what the Invesco S&P 500 Momentum ETF (NYSEARCA:SPMO) does. The fund tracks the S&P 500 Momentum Index, which invests within the 100 highest-momentum shares within the S&P 500. Its portfolio rebalances twice a yr.

The fund’s method relies on the concept that, by investing in corporations with the strongest upwards worth tendencies which are most certainly to maintain their outperformance, it will probably harness persistence for an additional increase to efficiency. By rebalancing the portfolio to carry the best-performing momentum shares, SPMO goals to let traders catch a experience with the market’s leaders, whereas on the similar time avoiding the risks of inventory choosing.

A Look At The Holdings

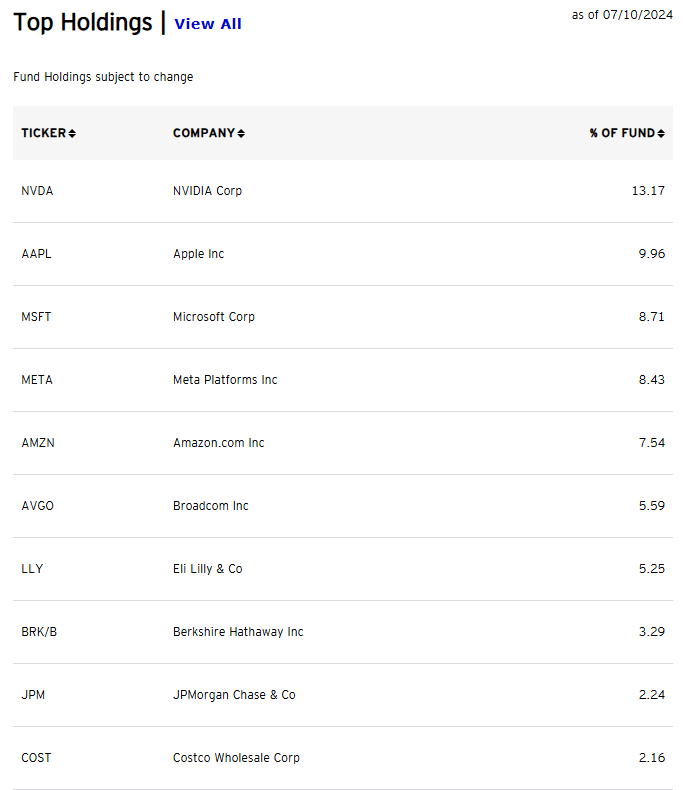

The fund at present holds 101 positions. The biggest place, Nvidia (poster youngster of momentum) makes up 13.17% of the fund. Sure, people – should you needed a momentum fund, that momentum fund higher have Nvidia on the very high.

invesco.com

All the positions listed here are corporations you realize, simply with a better weighting general than in broader passive benchmarks just like the S&P 500 itself. I’ll say that the fund has been on hearth due to the names it’s in, whereby the rebalancing frequency of twice a yr has allowed momentum to compound in a few of these high-flyers.

A robust case to be made to date, however the factor with momentum investing is that when it turns, it will probably flip ugly. That clearly hasn’t occurred but, nevertheless it’s value enthusiastic about given how a lot focus there may be within the high 10 names.

Sector Composition

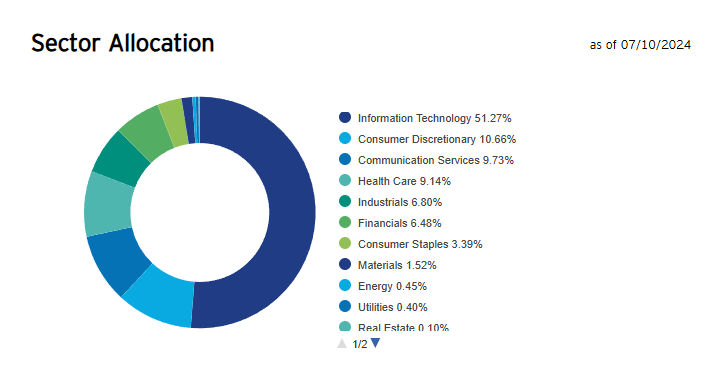

The high-growth, modern corporations that SPMO focuses on additionally drive the excessive publicity the fund has to the Info Expertise sector. Practically 52% of the fund is in Tech, with Shopper Discretionary a distance second at 12% and Communication Providers at practically 10%. This hefty publicity to the tech superstars – Nvidia, Microsoft and Apple, amongst others – isn’t a shock. Everyone knows how concentrated Magazine 7 efficiency has been relative to all the things else, and everyone knows Tech has been the one actual place to be from a momentum perspective for the reason that very finish of 2022.

invesco.com

Execs and Cons

Continuously holding the best-performing shares seems to be like a winner on paper – however ought to traders in SPMO count on momentum or mayhem? On the optimistic facet, momentum investing appears to work. For the reason that Dow Jones Index was first calculated, worth tendencies have tended to persist far longer than a random stroll would predict. By frequently rebalancing shares, a momentum ETF like SPMO can surf market leaders, which in flip ought to enhance returns.

The issue is momentum does are likely to have momentum crashes that seemingly come out of nowhere once they hit. Chasing this technique pushes you alongside a slippery slope due to that threat. It’s simple to begin believing in hot-stock efficiency persevering with, however in some unspecified time in the future you’ll turn into overinvested in yesterday’s sizzling shares, simply as everybody else does. You’ll miss out on investing within the shares that may really carry out properly tomorrow. That’s the joke about momentum. You want momentum for momentum to happen.

As well as, as a result of SPMO has big publicity to the Expertise sector, this fund is very weak to a downturn there. I do know it’s arduous to ascertain a state of affairs the place Tech weakens, nevertheless it was arduous to ascertain that Tech would flip in early 2000 as properly. The purpose is there may be vital threat right here, which, though it’s working, may reverse and finish badly.

Conclusion

In order for you publicity to a momentum portfolio within the US large-cap fairness market, the Invesco S&P 500 Momentum ETF may very well be a pretty avenue for capturing momentum returns. Its portfolio is dynamically managed to comprise the shares with the very best momentum throughout the S&P 500. Nonetheless, traders have to be conscious there’s a potential for sharp reversals and intervals of underperformance due to the inherent threat within the momentum technique. Furthermore, the concentrated sector publicity in SPMO will result in a rise in volatility and firm-specific trade dangers. Personally, I’d be afraid of positioning into the fund now, given how prolonged it’s. Nonetheless – value maintaining a tally of.

Get 50% Off The Lead-Lag Report

Get 50% Off The Lead-Lag Report

Are you bored with being a passive investor and able to take management of your monetary future? Introducing The Lead-Lag Report, an award-winning analysis instrument designed to provide you a aggressive edge.

The Lead-Lag Report is your each day source for figuring out threat triggers, uncovering excessive yield concepts, and gaining helpful macro observations. Keep forward of the sport with essential insights into leaders, laggards, and all the things in between.

Go from risk-on to risk-off with ease and confidence. Get 50% off for a restricted time by visiting https://seekingalpha.com/affiliate_link/leadlag50percentoff.

[ad_2]

2024-07-15 00:00:00

Source :https://seekingalpha.com/article/4703974-spmo-hope-you-love-tech?source=feed_all_articles

Discussion about this post